SMART INVESTING NEWSLETTER

CPI, China Owning U.S. Debt, Growth Companies, Future Workforce, Chipotle, Investing in Technology, Dishwashing, Media Hype, Jobs Report, NAR & Understanding Tax Phases

China Owning U.S. Debt

I have heard people worry about China owning U.S. treasury debt. Over the last decade or so, it truly has become a very small concern. China now holds just $782 billion of our debt which trails Japan at $1.1 trillion. China still tops the UK, but the gap has been narrowing over the years as the UK now holds $716 billion of US debt. The next largest foreign holders of our debt are Luxembourg at $371 billion and Canada at $321 billion. With our debt now over $34 trillion, China owns just over 2%. Compare this back to 2013 when Beijing’s holdings peaked at just over $1.3 trillion and our debt stood at close to $17 trillion and you will see the concerns over China controlling our debt are currently overblown. Back then they owned over 7% of our debt. The main benefit here is China no longer could threaten dumping our debt and causing a major spike in interest rates. The downside is our debt has continued to grow and with less demand for our debt from China, interest rates are likely higher than they would be if China was actively participating in buying more of our debt. Remember like everything else these markets are based on supply and demand. If there is more demand for our debt, prices would go higher and since there is an inverse correlation, interest rates would go lower.

Growth Companies

I don’t like to invest in the expensive growth companies because of the risk that comes with them. People often forget how much value they can lose and how long the recovery can be. One great example of this is Microsoft during the Tech Boom. In 1999, Microsoft could do no wrong and they were one of the most exciting companies in the world. The stock hit a peak of a split-adjusted value of $59.96 per share in December of 1999. The stock then fell dramatically during the tech bust and financial crisis and bottomed out in March 2009 at a price of $15.15 per share. This resulted in a decline of about 75% over essentially a 10-year period. The shares would not reach the 1999 peak until October 2016, essentially 17 years after it reached the tech boom peak. While the stock has done well as of late, how many people are patient enough to hold through a 17-year period with no growth? Not to mention if you need income from your portfolio, that would have been a complete disaster. While tech is hot again, I still recommend people be careful as they often forget the lessons from the past.

Future Workforce

Times are changing and baby boomers that were born from 1946 to 1964 are leaving the workforce. This year it appears that generation Z, those born from 1997 to 2012, will surpass baby boomers in the workforce at 20.88%. This compares to baby boomers at 20.58%. Each year this will continue as the baby boomers continue to retire and generation Z continues to enter the market. Being a baby boomer myself, I’m a little bit worried about the future workforce. But thinking back when I was in my mid-20s, I’m sure the older generation was concerned about the future workforce as well. I do try to help and mentor younger adults, either about to enter the workforce or that are new to the workforce on how to be successful in the business world and how to work hard. I always tell them if you work hard, life is easy, but if you take it easy and don’t work hard, life is hard.

Chipotle Stock

OK I admit it, I don’t get all the excitement around Chipotle Mexican Grill (CMG). I can’t remember the last time I was there, but their stock has done very well over the years and I continue to ask why are people paying over 50 times earnings for a burrito company? Chipotle is looking at adding 7000 restaurants in North America and adding 19,000 new full and part-time employees. 73% of their employees are in the generation Z category and were born from 1997 to 2012. The benefits are rather attractive for the younger generation and Chipotle says it will help employees pay off student loans while saving for retirement. They will also help them build credit with the use of a debit card and provide access to mental health resources and financial education. I think I’ll have to go into a Chipotle again and check to see how happy the employees are and maybe the expensive burritos are pretty good?

Investing in Technology

In 2023 technology stocks far exceeded our investment returns for the year, especially if you had the mag seven in your portfolio. Managing money through the tech boom and bust back at the turn of the century I still remember how painful it was for technology investors. Many never recovered, and left the markets and missed very good gains in other industries and sectors that did well. At Wilsey Asset Management we have not participated in the AI boom as we just don’t see how it will increase earnings that much for businesses. I do read many positive articles about AI, but I always see a little bit of uncertainty from those speaking. For instance, a manager of a $10.3 billion technology fund who has been in the tech sector investing arena for over 30 years recently discussed Microsoft’s Office Copilot and used the words “if we see adoption of copilot.” The keyword is “if”. I congratulate those who have made good returns by investing in technology, but at our firm we are more concerned with long-term protection of capital, than high returns with a high risk.

Pre-Wash vs Dishwasher

I

try my best to help save water, even though California could have plenty of

water if they would build the infrastructure to keep it. Anyways, one area that

I could save water on is pre-washing dishes before they go in the dishwasher.

I’ve done the research and most the time it comes up that you don’t have to

pre-wash even the back of the dishwashing container says you don’t need to

pre-wash. But I can’t help to think that they need to be pre-washed. In my research

I did discover that the dishwasher uses about 4 gallons of water for the entire

cycle, but pre-washing uses about 4 gallons of water every two minutes. I’m

curious how many other people pre-wash their dishes versus just throw them in

the dishwasher as is? If you just throw them in the dishwasher, do they come

out clean when the dishwasher is done?

Media Hype

I just love how the media hypes up what looks like bad news. I saw a headline that said “credit card debt smashed another record high at the end of 2023”. Another exciting word they used was credit card debt SURGED to $1.13 trillion, an increase of $50 billion. Yes, this is the highest on record, but so is the net worth of consumers as well. The other thing they don’t reveal is how many more cards have been issued since the economy is doing well and that there are likely more people using credit cards as well. The service economy is strong with people eating out, traveling and going to concerts. The fear crowd will point to the delinquency rate that was 3.1% in December as it increased from 3% in the previous quarter. But the delinquency rate prior to COVID-19 when we had a good economy was at 4.7%. At this point, I am not concerned with the increase in credit card debt. We have a good economy and a strong job market; people are spending money and they perhaps even get bonus miles or cash back for using their credit cards. That’s another good question that I don’t know where the answer is, but what is the value of all those miles and cash rewards that people are earning?

Jobs Report

In the most recent jobs report we saw that wages were up over 4% year-over-year for workers. That may be leading workers to stay put in their jobs based on how many quit in 2023 compared to 2022. Those who quit their jobs declined 12% or 6.1 million in 2023 from the previous year. There are still plenty of jobs out there and I do believe that overall, more workers are satisfied with their job and their pay and this is leading them to stay put.

National Association of Realtors

Many times, in our posts and newsletters when talking about real estate we will mention the National Association of Realtors known as the NAR. But like myself, you may not know much about the NAR but they have been around for over 100 years and they were founded back in 1908. They have more than 1.5 million members, total assets of $1 billion and the last financial reports showed they had over $100 million in cash. Another interesting point is that in 2023 they spent $52 million on federal lobbying, the only organization that spent more was the US Chamber of Commerce. The NAR has the job of helping real estate agents across the country, which has become an uphill battle since the $1.8 billion jury verdict found them and a couple of brokerages guilty of conspiring to keep broker commissions high. I do believe the future for the NAR and real estate agents will change in the years to come, including a likely change and reduction of their commissions. In 2022 the average commission across the country was 5.3%. Home sales were down in 2023 to 4.09 million homes sold in the US and that was the lowest since 1995. I don’t see that changing dramatically going forward, but what will likely happen is many agents will be willing to reduce their commissions to get the business.

Financial Planning: Understanding You Tax Phases

Sometimes it feels like taxes only go up, but it doesn’t have to be that way. In fact, most people go through different tax phases during their lives. While you’re working, taxes seem high because you’re subject to 5 different taxes. You are taxed federally, on the state side, and you have Social Security, Medicare, and disability taxes withheld from payroll. Then when you retire, things change. You’re no longer subject payroll taxes, which in California is a flat tax of 8.75%, and some of your retirement income may be partially or fully tax-free. For many this is a period of low taxation which means you don’t need as much total income to produce your after-tax cash flow. Then in your 70’s, you may see your taxes increase again due to required distributions from retirement accounts and extra premiums for Medicare. By understanding these different tax phases over time, you can take advantage of your tax situation and create a plan to save taxes over your lifetime.

CPI

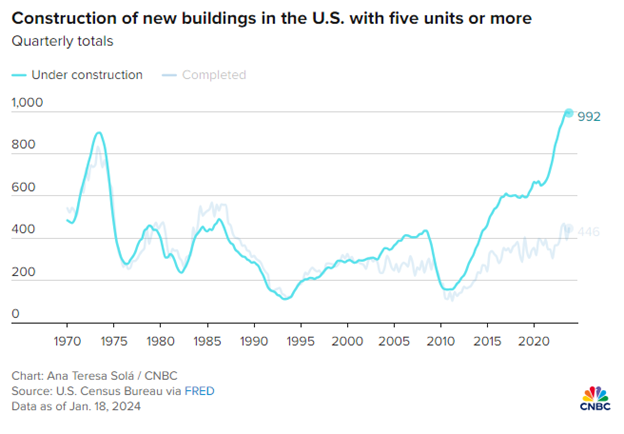

One of the main reasons I continue to believe the Consumer Price Index (CPI) will continue to decelerate this year is I don’t believe there will be as much pressure from the shelter index. In December, the median U.S. asking rent price fell 0.8% from the prior year to $1,964. According to Redfin, this marked the third consecutive monthly decline as prices dropped 2.1% in November and 0.3% in October. The rent price reflects new leases which means I believe this will have a larger impact as we progress through 2024. I believe there will be even less concern over rent increases going forward considering the number of new buildings in the U.S. with five units or more. Looking at the chart below you can see that the amount of completed buildings is near the highest level in over 30 years and the number of new buildings under construction is at levels we have not seen before.